Press Releases

TSUNEISHI Group Announces FY2022 Earnings Up 30.4%

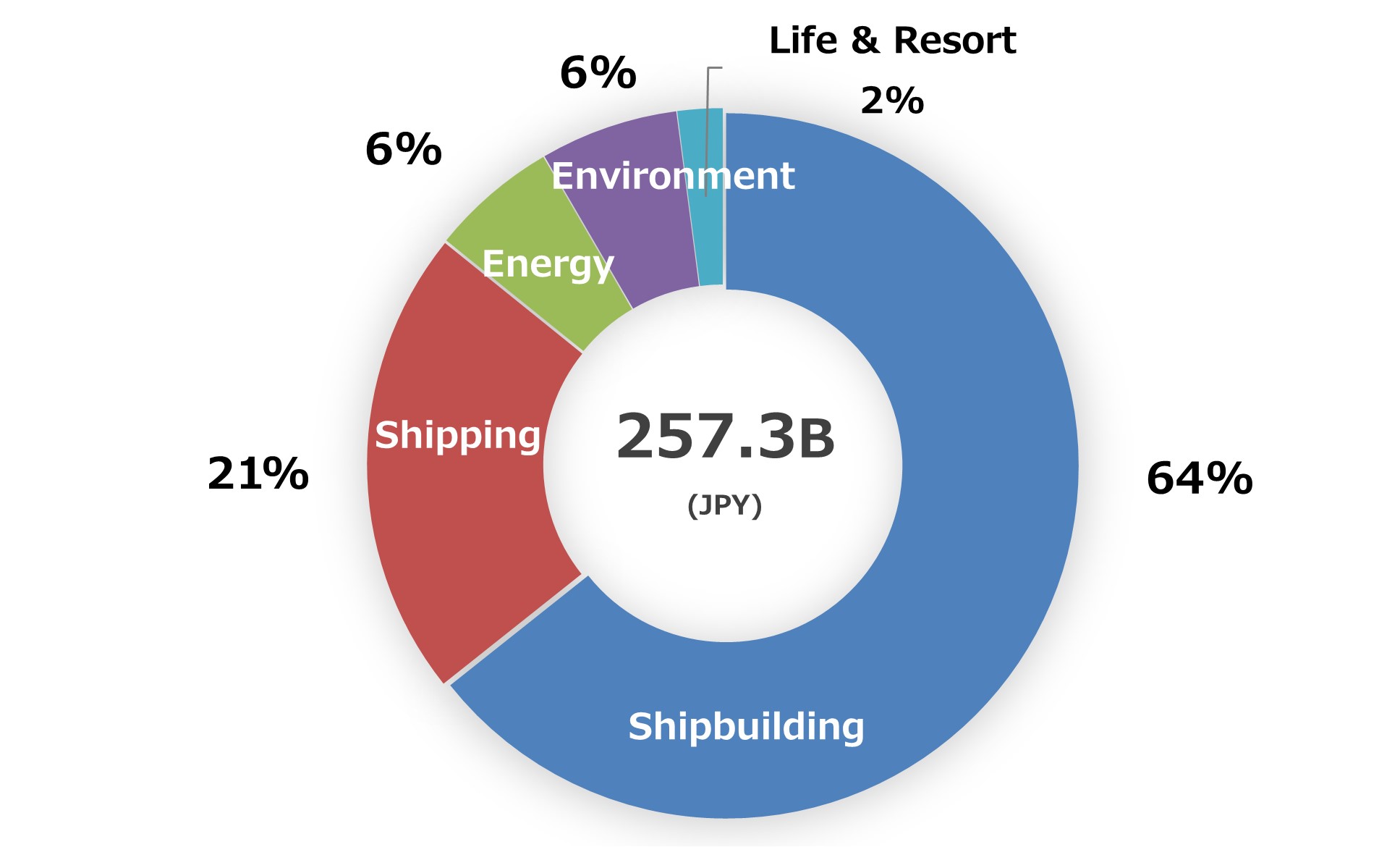

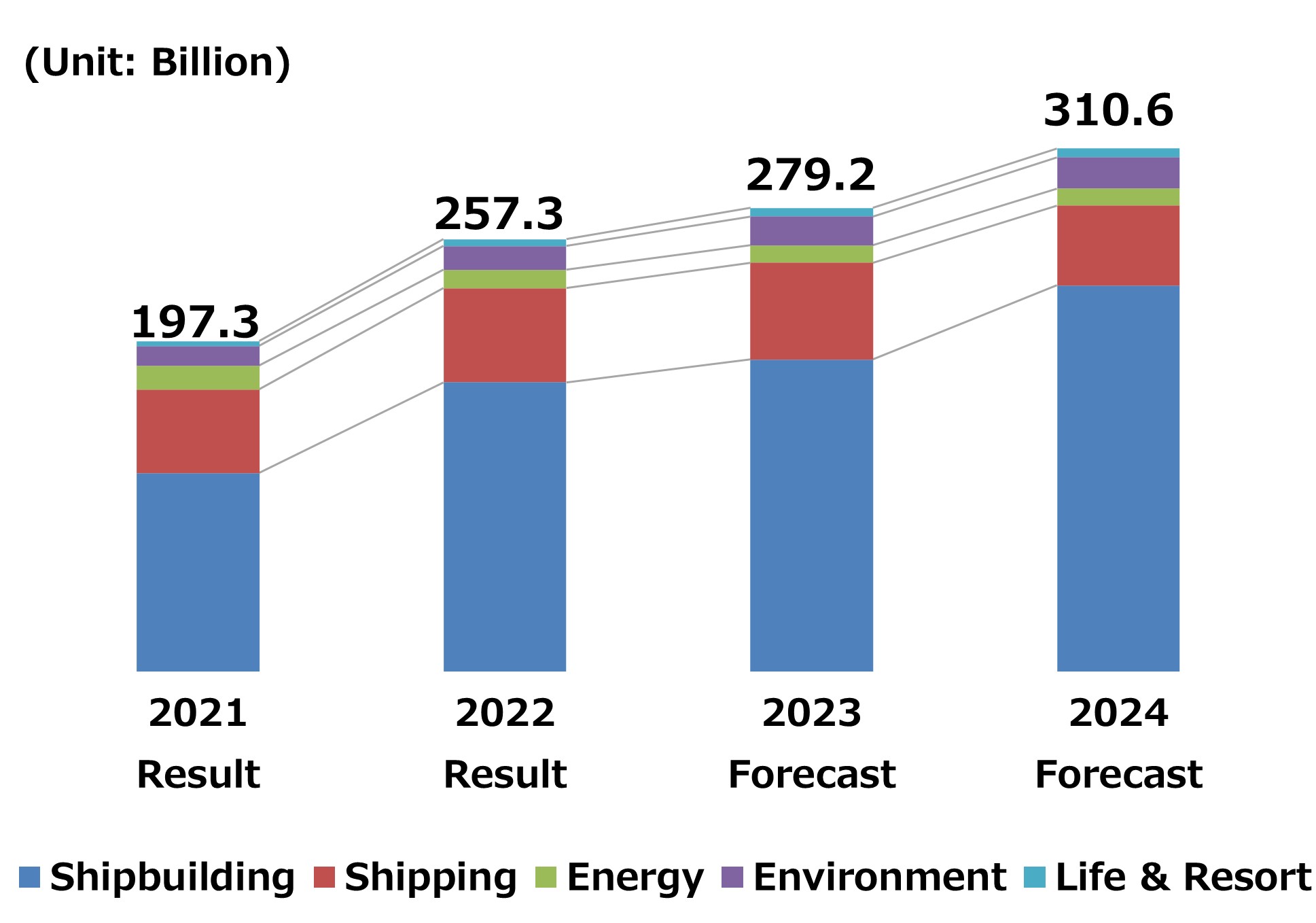

TSUNEISHI HOLDINGS CORPORATION (HQ: 1083 Tsuneishi, Numakuma-cho, Fukuyama, Hiroshima, Japan; President: Hirotatsu Kambara) earned 257.3 billion yen (+60 billion yen YoY) in consolidated sales for FY 2022 (January 1–December 31, 2022).

In our core businesses in the shipbuilding and shipping industries, the previously favorable shipping market conditions trended downward in the latter half of the year and factors such as caution about environmental ships caused new shipbuilding orders to stagnate. Despite these trends, our shipbuilding business achieved our target of orders for 35 ships in this fiscal year, mainly for bulk carriers. We also newly acquired three Mitsui E&S Shipbuilding group companies and Kanda Dockyard Co., Ltd. as consolidated subsidiaries to enhance our shipbuilding and repair businesses. We aim to manifest additional synergy through group cooperation, including with our shipping business.

Earnings by business segment: shipbuilding, 191.0 billion yen (+29% YoY); shipping, 62.3 billion yen (+0.5% YoY); energy, 12.7 billion yen (-28% YoY); environment, 15.9 billion yen (+8% YoY); and life & resorts, 4.7 billion yen (+35% YoY). (*All figures are before offsetting internal transactions.)

Based on our value of “Being one with the community,” TSUNEISHI HOLDINGS drafted the “Basic Policy on Sustainability Promotion” with the aim of realizing a sustainable society. We consider climate change-related phenomena to be a management risk; while addressing this appropriately, we will create new opportunities that link to strengthening our business foundations.

<Settlement Notes>

・Fiscal Year: January–December

*Percentage-of-completion method sales for the shipbuilding business

・FY 2022 onward: new revenue recognition standard applied

・Consolidated companies: 46 companies (23 in Japan, 23 abroad), including TSUNEISHI HOLDINGS

Shipbuilding Business

■ FY2022 Overview

The shipbuilding and shipping industries had a promising start as the market showed recovery from 2021. However, the large volume of orders for new container carrier ships became a common topic of concern as container carrier shipping charges headed downward from around summer. Charterage for bulk carriers also started declining at the same time, triggering the slowdown of sales negotiations for new shipbuilding. Amid these circumstances, TSUNEISHI SHIPBUILDING received orders for 35 bulk carriers and delivered 38 built ships, comprising container carriers, tugboat, and bulk carriers.

In this business year, we additionally acquired 10,200 shares, the equivalent of 17% of the issued shares, of our affiliate Mitsui E&S Shipbuilding Co., Ltd. We also separated the repair section of Kanda Shipbuilding by establishing Kanda Dockyard Co., Ltd., and purchasing 1,000 shares, (100% of the issued shares), to make this a wholly-owned subsidiary.

・Sales: 191.0 billion yen (FY2021: 147.7 billion yen, +29.3% YoY)

・Number of ships built: 38 (FY2021: 41)

* Number of ship orders received by TSUNEISHI SHIPBUILDING, TSUNEISHI HEAVY INDUSTRIES (CEBU), TSUNEISHI GROUP (ZHOUSHAN) SHIPBUILDING combined: 35 (FY2021: 81)

■ Outlook

To accommodate new marine transport demand and future social structure changes, the shipbuilding segment will focus on developing next-generation fuel ships and zero-emission ships that combine economy with a reduced environmental burden. We will also accelerate research of autonomously-operated ships and data-driven management through digital innovation, with the aim of improving customer lifetime value. At the same time, we will boost workstyle reform and human resource development to build a workplace in which employees can enjoy better job satisfaction.

We also welcomed Mitsui E&S Shipbuilding Co., Ltd., Niigata Shipbuilding & Repair, Inc., Yura Dock Co., Ltd., and Kanda Dockyard Co., Ltd to the TSUNEISHI Group. This adds the Group shipping business to the new shipbuilding and repair businesses, and linking all these will drive powerful synergy. By constantly transforming, we will transcend convention to create new added value for our customers, communities, and society, while achieving both ESG management and a competitive edge to contribute to the sustainable growth of the Group.

Shipping Business

■ FY2022 Overview

The year was unpredictable, with factors such as the rising prices of resources and raw materials and the abrupt depreciation of yen from March onward. For the new shipbuilding dealing business, two ships were resold (FY2021 was seven ships), causing a marked decline of income. However, we actively set ship chartering fees in consideration of ship-chartering market standards, especially for our main dry bulk business, thus reducing market fluctuation risk. The container transport volume in our container liner business slightly declined, but as the new surcharge adopted in October 2021 gained traction, some of the raised bunker (fuel) prices were transferred to significantly improve freight unit prices.

As a result of the key factors above, consolidated sales of the 11 shipping-related companies came to 62.3 billion yen, which was about the same as the previous year.

・Sales: 62.3 billion yen (FY2021: 62.0 billion yen, +0.5% YoY)

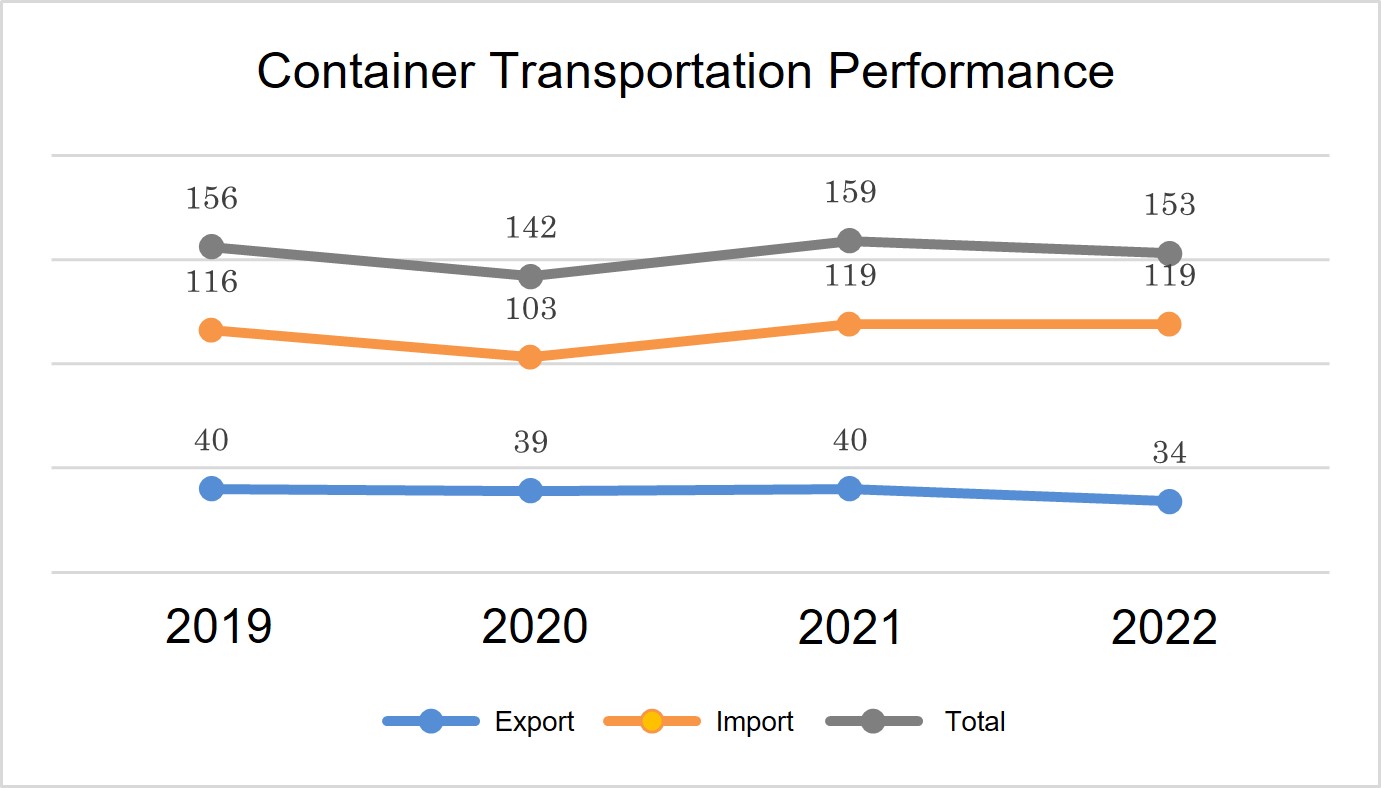

・Container transport volume: 153,000 TEU (FY2021: 159,000 TEU, – 3.8% YoY)

■ Outlook

To manage environmental regulations that are becoming increasingly strict, we will continue to collaborate with TSUNEISHI SHIPBUILDING to address next-generation environmentally-friendly ships and promote decarbonization. Another measure will be to distribute risks, aiming to improve market condition tolerance by ambitiously working to diversify ship types (lower the ownership ratio of bulk carriers and increase that of other ship types).

In the container liner business, we will explore new routes and services. At the same time, we will set our services apart from the competition by prioritizing digital transformation in this field, updating the core system as a proposition to improve customer value, developing and providing related digital services, and committing to the hiring and empowerment of female crew members. Our aspiration is to shift from a “steady business” to a “growth business.”

For ship management, we will aim to build a high-quality ship management system to become the ship company chosen by customers. The average age of our owned ships (48 in all) as of the end of December 2022 is 4.4 years, and we will continue to replace these with the latest ship models with excellent environmental performance. We consider the various challenges related to environmentally responsible corporate practices to be favorable opportunities. By tapping the synergy of the TSUNEISHI Group, we will aim for a shipping business in which the environment and economy are compatible.

Energy Business

■ FY2022 Overview

The energy and auto industries both continue to struggle worldwide as the decarbonization movement accelerates and the semiconductor shortage causes a drop in car manufacturing volume. Nonetheless, fuel oil sales volume and gross profit in the energy business, as well as vehicle sales volume and vehicle inspection volume in the mobility business all increased YoY. However, as the accounting standard was revised to the new revenue recognition standard, companywide sales came to 12.76 billion yen, a YoY decline of 28.1%.

・Sales: 12.76 billion yen (FY2021: 17.75 billion yen, -28.1% YoY)

■ Outlook

We will provide a stable energy-supply service with anticipation of energy conversion in the future, while developing new services to provide new value to customers.

We will continue to value our ties and history that have been built while rooting ourselves in the community and respecting customer lifestyles. At the same time, we will amplify our businesses that are competitive and aim to deepen coordination with the various operating companies of the TSUNEISHI Group to maximize synergy. This synergy will be rolled out globally to further strengthen the business foundation in the Philippines as well. For new and existing businesses, we will identify diversifying social needs and sustain business growth by emphasizing balanced investments.

Environment Business

■ FY2022 Overview

While the impact of the COVID-19 pandemic has gradually waned and economic activity is slowly recovering, factors such as facility maintenance and a fire caused TSUNEISHI KAMTECS disposal volume to decline at the Fukuyama Factory. However, metal recycling at the Saitama Factory is performing well.

With the objective of enhancing our metal recycling business (expanding our value chain) and expanding waste disposal orders by securing a base in the Hokuriku region, our Group acquired Yoshida Co., Ltd. (located in Imizu City, Toyama Prefecture) and made it subject to consolidation, thus boosting sales in this business year to 15.9 billion yen.

・Sales: 15.9 billion yen

■ Outlook

As an initiative to develop a recycling-oriented supply chain and reduce the environmental burden, we will invest in facilities to improve the waste recycling rate, reduce CO2 emissions, decarbonize, and provide services with high-added value. We will also enhance safety operations (no accidents / no disasters) and compliance, striving to build a relationship of trust with stakeholders.

With our vision of “becoming an indispensable presence for achieving a sustainable society,” we will continue to respond to needs that change constantly, implementing measures such as actively integrating new technologies that will enable us to lead the environmental recycling industry.

Life & Resorts Business

■ FY2022 Overview

In the life & resorts business that focuses on hotels and leisure facilities, the first half of the year was a struggle as the spread of the omicron variant brought domestic demand to a standstill. In the second half of the year, Japan transitioned to the new stage of “life with COVID,” gradually loosening inbound travel restrictions and other policies to trigger a recovery trend. As a result, YoY income increased for: Setouchi Cruise, Inc., which mainly operates guntû; Tsuneishi Resort, Inc., which operates Bella Vista Spa & MARINA ONOMICHI; TLB, Inc., which operates ONOMICHI U2 and LOG; and TSUNEISHI LR, Inc., which operates MIROKU-NO-SATO and restaurants.

・Sales:4.7 billion yen (FY2021: 3.5 billion yen, +34.3% YoY)

・YoY: Setouchi Cruise +500 million yen; Tsuneishi Resort: +300 million yen;TLB +100 million yen; TSUNEISHI LR +400 million yen

■ Outlook

An absorption-type merger for three of the four life & resort businesses became effective on January 1, 2023, with Setouchi Cruise being the surviving company to restructure Setouchi Cruise, Tsuneishi Resort, and TLB. This restructuring will integrate the knowledge fostered by each company and management resources, such as personnel. We will pursue customer satisfaction by boosting service levels and enhance the value of Setouchi, under the slogan of “Setouchi: the chosen destination of the world.”

With safety and assurance as our highest priority, we will take the perspective of preserving and fostering the local environment, culture, and economy, aiming to deliver high-quality services to customers while striving to contribute to and develop the local community.

For further information, please contact:

Communication Dept.

TSUNEISHI HOLDINGS CORPORATION

pr@tsuneishi.com

+81-84-987-4915