Press Releases

TSUNEISHI Group Announces FY2023 Consolidated Performance

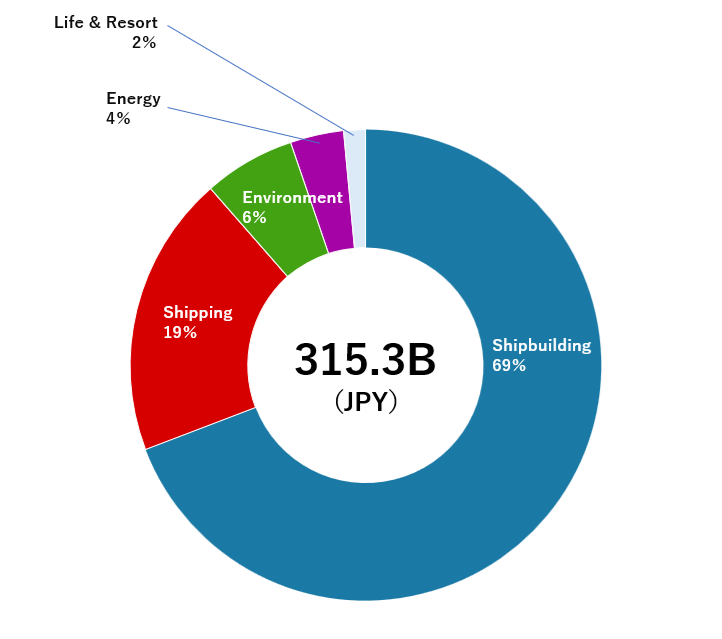

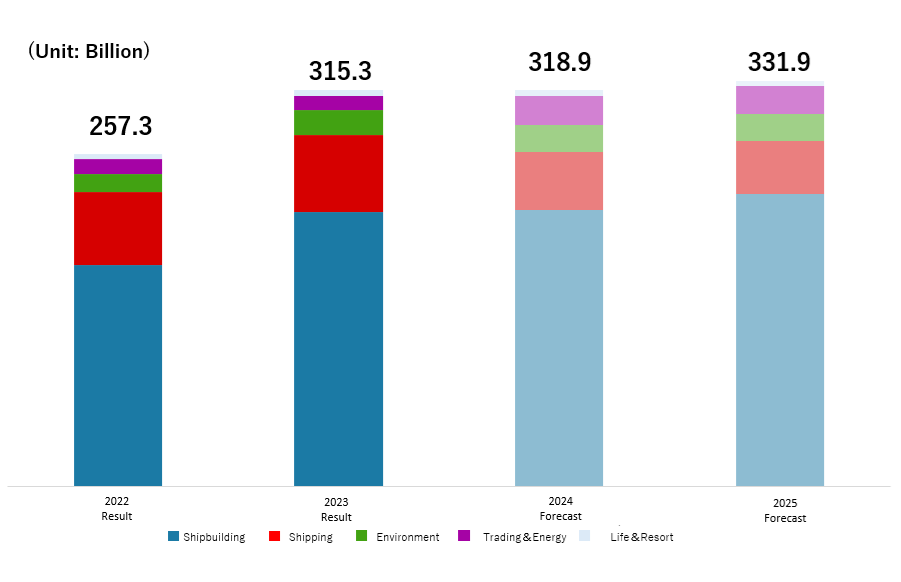

TSUNEISHI HOLDINGS CORPORATION (HQ: 1083 Tsuneishi, Numakuma-cho, Fukuyama, Hiroshima, Japan; President: Hirotatsu Kambara) earned 315.3 billion yen (+22% YoY) in consolidated sales for FY 2023 (January 1–December 31, 2023).

Uncertainty continues in the global economy this business year; while there have been signs of recovery from the COVID-19 pandemic, we faced price hikes triggered by the soaring prices of energy and resources as the result of prolonged conflicts and other consequences.

Amid these circumstances, shipping market conditions in the latter half of the year trended downward in the shipbuilding and shipping industries in which our core subsidiaries operate. China’s economic growth slowdown added to the impact, and container transport volume declined YoY. However, the end of the COVID-19 pandemic revitalized demand for long-term fixed chartered ships, especially for the automobile industry, and this served to boost steady sales YoY for our shipping business. As for new shipbuilding, the number of orders greatly increased; in addition to orders for the world’s first methanol-fueled bulk carrier, the KAMSARMAX AEROLINE, we received numerous inquiries as well as orders for approximately 30 methanol dual-fuel combustion ships for their feature of contributing to a reduced environmental burden.

Earnings by business segment were: shipbuilding, 236.2 billion yen (+24% YoY); shipping, 66.1 billion yen (+6% YoY); energy, 12.4 billion yen (-2% YoY); environment, 21.6 billion yen (+36% YoY); and life & resorts, 5.2 billion yen (+10% YoY). (*All figures are before offsetting internal transactions.)

The TSUNEISHI Group considers a steady business foundation to be vital amid a rapidly changing social environment and will transition to become a corporate group that can tolerate market fluctuations. Furthermore, the three elements of “Green,” “Digital,” and “Human Resources” will be positioned centrally to our management policy to drive sustainable growth. While building momentum for growth through strategic investment, we will gain a competitive edge by continuing to adapt to changes and by transforming social issues into corporate value.

■TSUNEISHI Group FY2023 Consolidated Sales

<Settlement Data>

・Fiscal year: January–December

・Consolidated companies: 43 companies (23 in Japan, 20 abroad), including TSUNEISHI HOLDINGS CORPORATION

Shipbuilding Business

- FY2023 Overview

TSUNEISHI SHIPBUILDING released the “TSUNEISHI SHIPBUILDING roadmap of CO2 emissions reduction” with the targets of producing only dual-fuel ships by 2035 and achieving carbon neutrality by 2050*1. This was formulated ahead of the International Maritime Organization target that was formally set in July 2023 for reducing greenhouse gas (GHG) emissions from global shipping. TSUNEISHI SHIPBUILDING engages daily in research and development aiming to create zero-emission ships, which has led to receiving an order for the world’s first methanol-fueled bulk carrier, the KAMSARMAX AEROLINE, early in the year. This was followed with orders received for the methanol-fueled bulk carrier, the TESS66 AEROLINE, a methanol-fueled 5,900TEU type container carrier, and more, for a total of approximately 30 ships.

*1 TSUNEISHI SHIPBUILDING roadmap of CO2 emissions reduction:

https://www.youtube.com/watch?v=lRxzC8D5t7M&t=48s

These innovative initiatives were effective and enabled us to receive orders for 62 ships in this business year, thus securing construction volume through 2027. The number of completed ships came to 43, largely due to the steady production operations at our two overseas factories.

- Sales: 236.2 billion yen (FY2022: 191.0 billion yen, +24% YoY)

- Number of ships built: 43 (FY2022: 38)

* Number of ship orders received by TSUNEISHI SHIPBUILDING, TSUNEISHI HEAVY INDUSTRIES (CEBU), TSUNEISHI GROUP (ZHOUSHAN) SHIPBUILDING combined: 62 (FY2022: 35)

- Outlook

As we aspire to be a leader of environmental response and to achieve the TSUNEISHI SHIPBUILDING roadmap of CO2 emissions reduction, we will promote the development and construction of new fuel ships powered not just by methanol, but also LNG, ammonia, hydrogen, and other alternative fuels that allow for both reduced environmental burden and economy. In preparation for this, we are shifting to LNG tank self-manufacturing in 2024 for the eventual expansion of construction and demand for new-fuel ships.

To improve our tolerance to the risks of external environmental changes and to address the need for construction periods for new-fuel ship building, we are planning new manufacturing locations. Furthermore, our open platform “seawise,” which was launched two years ago to assist better lifetime value for ships by maximizing the value of data, will digitally support the maintenance and operation of dual-fuel ships that will become increasingly sophisticated. We will build a more robust business foundation by bringing these to fruition.

The new medium-term business plan developed last November touts the “Establishment of a competitive edge through ESG management.” TSUNEISHI SHIPBUILDING has designated the practice and deepening of ESG management to be at the core of management, setting targets for each business unit from the angles of green technology, digital innovation, better lifetime value, human resource development, and aspiration for new domains. All employees will work to realize the TSUNEISHI SHIPBUILDING vision of “Innovate ourselves, create new value” under the TSUNEISHI Group slogan of “Creating the future, today.”

Shipping Business

- FY2023 Overview

For our nonliner business, we were concerned about the impact of surging energy prices and the wait-and-see attitude of consumer behavior triggered by inflation, but freight movement for the full year reached our year-start estimate with factors such as increased Brazil grain freight movement and increased coal for India and China in the second half of the year.

For our container liner business, the real estate slump in China has slowed personal consumption and impeded China imports/exports. As a result, transport volume declined YoY.

KAMBARA KISEN has been engaged in decarbonization and the loading of green fuels in advance of international environmental regulations and has conducted demonstration tests for using biofuel as vessel fuel together with Toyota Tsusho Corporation in this business year. KAMBARA KISEN is accelerating initiatives from a range of angles, including signing its first ship-chartering contract for a methanol dual-fuel ship on which construction will be completed in 2027.

- Sales: 66.1 billion yen (FY2022: 62.3 billion yen, +6% YoY)

- Outlook

The direct container service between key Chinese ports and local Japanese ports (China-Japan regular container service), which is our core business, will mark 30 years since its start in 1994. With the so-called 2024 logistics problem, we anticipate the possibility that the business will become more accommodating of consigner needs. The service that many clients utilize will continue to focus on China-Japan transport while extending the service network to Southeast Asia, South Asia, and the Middle East, so we will contribute to regional revitalization and economic development as an international transportation service provider.

While continuing to actively deploy new-fuel ships to address decarbonization in marine transportation, we will also address the issue of crew shortage by promoting female crew and developing human resources, aiming for the unprecedented goal of having female crew on all KAMBARA KISEN ships.

Environment Business

- FY2023 Overview

In the environment business industry, with surging energy prices and initiatives such as reducing GHG emissions being actively implemented to achieve a recycling-oriented society, waste volume is declining in Japan. Despite this, TSUNEISHI KAMTECS recorded steady sales with measures such as revising unit prices for processing. Also, by taking over the TSUNEISHI C VALUES CORPORATION automobile recycling business in January, TSUNEISHI KAMTECS is expanding its steel and nonferrous metal recycling business and engaging in the business of recycling solar panels and lithium-ion batteries, which will become a social issue.

Furthermore, Cycle Trend Industries Sdn. Bhd. of Malaysia, which has a successful global nonferrous metal recycling business, has been consolidated, bringing increased revenue for sales in the overall environment business.

- Sales: 21.6 billion yen

- Outlook

In alignment with the global trend of aiming to reduce the environmental burden, we will actively engage in measures such as decreasing CO2 emissions and developing a circular economy by boosting waste recycling rates.

We will especially promote technology development and facility investments to adapt to business environment changes, such as addressing waste that is challenging to process and new regulations for per- and polyfluoroalkyl substances (PFAS).

Based on the vision of “becoming essential to achieving a sustainable society,” we will enhance coordination between our environment business companies and aim to build a recycling-oriented supply chain.

Trading & Energy Business

- FY2023 Overview

In the energy business, the fuel oil sales volume was level YoY and we secured about the same level of sales as the previous year while reflecting the ongoing social shift to next-generation vehicles. Also, the car recycling unit was split with business being transferred to TSUNEISHI KAMTECS.

- Sales: 12.4 billion yen (FY2022: 12.7 billion yen, -2% YoY)

- Outlook

To convert the business structure in the face of heightened global environmental awareness and consumer trend changes in this business category, we merged Tsuneishi Trading Co., Ltd., TSUNEISHI C VALUES CORPORATION, and TSUNEISHI CAPITAL PARTNERS in January 2024, making a new start as TSUNEISHI CORPORATION.

TSUNEISHI CORPORATION takes on trading and energy functions and will develop business in the five fields of steel & machines, environment promotion, business development, energy, and mobility. Particularly for business development, TSUNEISHI CORPORATION will engage in the creation of new businesses, which will be imperative to the next-generation TSUNEISHI Group in perspective of future social changes. For this reason, we will not only actively invest in business, but also enhance investment in education and personnel recruitment to spawn and foster new ideas.

Life & Resorts Business

- FY2023 Overview

The life & resorts business has gradually regained vitality as inbound (foreign tourism to Japan) demand recovered and economic activities normalized with the reclassification of COVID-19 to a Class 5 infectious disease. Business for guntû, which is gaining recognition as a “little hotel floating on the Seto Inland Sea,” is especially seeing an increase of new and repeat reservations from those who were refraining from travel. By maintaining a high occupancy rate, it posted record-high sales.

- Sales: 5.2 billion yen (FY2022: 4.7 billion yen, +10% YoY)

- Outlook

ONOMICHI U2 marked its 10th anniversary in March 2024. This has become an established landmark and base for Onomichi tourism and is loved by the locals as well. This year, 10th anniversary events will be held in phases in an effort to capture new customers and to express appreciation for patronage over the years.

We will continue to pursue customer satisfaction and upgrade services to accommodate inbound needs, aiming to create a customer experience that is unique to Setouchi, under the slogan of “Setouchi: the chosen destination of the world .”

The TSUNEISHI Group will pursue the stability and development of businesses to ensure the happiness of employees and will contribute to achieving a sustainable society by being one with the community and society.

For further information, please contact:

Communication Dept.

TSUNEISHI HOLDINGS CORPORATION

pr@tsuneishi.com

+81-84-987-4915